Every time you are confronted with a Lego set for sale your brain makes a decision on whether or not it would be a good purchase. Sometimes people put a lot of thought into this decision, other times not and it’s an impulse buy. Usually the main question that you ask yourself internally (if buying for investment) is can I make a profit on this set? This is often quickly followed by shall I buy it now or wait for a better deal at a later time? It’s this later decision that I’d like to examine more.

One of the main things discussed here on the Brickpicker forums is “deals”. Discounts on sets at all the major and minor retail outlets are poured over in detail. And rightly so, the effect of a discount on the initial purchase price of a set can have a significant impact for the investment return down the road. Probably secondary to that topic is EOL (End of Line) or expected EOL dates. When is the set going to retire from retail availability? This is often when the secondary market price begins its largest period of appreciation. What I struggle with at times and I’m sure many others are the same is combining the two. Is the discount right now large enough to justify holding the set for X amount of time before it goes EOL, or is my investment capital better put to use elsewhere? Sometimes it’s discussed or thought about but it’s not very often examined in any scientific or quantifiable way.

What I’d like to do in this article is come up with a formula that will guide decision making on whether it’s best to buy now or use your money for something else and perhaps buy later. There are a myriad of factors or variables that potentially come into play when making this decision, but there are 4 main ones that I’m going to focus on. These 4 variables should form the crux of any buying decision and if you can quantify them you’ll go a long way to simplifying part of the equation. The other variables can come into play afterwards, of which I’ll list some later and of course there are a few cautions along the way which I hope to point out as well. Bear in mind I’m only really attempting to try and map out the logic process that already does or should happen in your head when faced with a decision to buy and put some numbers into those process components.

Also, this decision making process is really only needed for investments purchased with a view to holding medium to long term, at least until after the set has gone EOL. It is not for flipping or parting out which usually require different purchasing strategies.

Let’s look at the 4 variables in detail and examine the things that will or may factor in to determining your individual values for them before uniting them into a combined formula.

Price

This is the easiest one to answer and the number should be known exactly. It’s the price of the set in question, after any discounts that may be on offer. Things to consider:

- Considering Lego VIP points earned (usually 5%) as a discount off the current set

- any promotional giveaways at their estimated value as another discount is also good accounting practice (but not essential)

- Don’t forget to add on any sales tax if applicable

- Add on the cost of shipping to you if buying online and it’s not shipped for free

- If the purchase has quantity discounts/offers such as BOGO (Buy One Get One) 50% off etc then take the sum of the purchase and divide by the quantity of sets to get an average for each one

Your Average Annual Rate of Return %

This one is a lot trickier and comes with many factors to consider which I’ll list below. For simplicity think of it as – What annual percentage return do you think you could get from using that money you are about to spend by putting it into a different set or even a different investment class (many people invest in things other than Lego). It is essentially your opportunity cost. Many experienced investors will know what their average annual ROI (Return on Investment) is across their entire portfolio if it is well tracked and documented (e.g. you made 40% profit last year – great use that). Others may not and after checking in on the forums with peoples thoughts on what an average might be it appears that opinions vary widely. Nevertheless you should spend some time to think on your own situation to come up with this percentage, there are many factors to mull over which include:

- Selling and Listing fees – you have to cash out sometime and taking expected fees off any paper based profits will give you a more realistic cash out figure

- Selling platform and market – related to the fees above, but also where you choose to sell can affect the price you get. Ebay, Bricklink, Craigslist, The local village market etc. Plus do you sell local, national, or international? It all adds in to determining your profitability.

- Postage & packaging - Some people factor them in to their selling price, others charge them on top to buyers. Either way it impacts your profits

- Damages & losses – Lost or damaged shipments to buyers (when buying yourself you are often covered by the retailer). Do your kids/dog rip into boxes etc. All adds in as an expense

- Gas & mileage – Do you drive out of your way to hunt for deals? Do you need to drive to the post office to ship sales? Add that cost in if you can or think it’s material

- Time – now this one is individual preference. Some serious investors like to cost in their time spent researching, deal hunting, buying, listing, selling, and shipping, at an hourly rate. Others don’t as they are doing it as a hobby and don’t see it as ‘a job’.

There is a good article detailing these and other expenses here.

Now you should have some idea of a reasonable annual rate of return that you could get by investing in other sets. Maybe you think you can make 20% on the stock market, go ahead and use that. It’s your choice dependent on your circumstances.

Expected EOL date

Now here’s the real tough one! It is very rare that the future EOL date of the set you are looking at is 100% known. It is almost always necessary to make your best educated estimate here. There is plenty of talk, rumours, speculation, and occasional hard fact, about EOL dates on the forums. There is good reason for that as when a set disappears from retail availability it usually starts to experience price growth on the secondary market, and that’s what we are here for!

So obviously you are not going to know the exact date, but there are some factors that you could consider to come up with your best guess:

- The time the set has been out - things like Ewok Village or Tower of Orthanc have just been released and you can reasonably expect them to be around for a good while longer. The average of 2 years retail is a decent yardstick for most average sets, but larger SW and modulars have pushed well past that. That leads into;

- The theme a set is from - Some themes have a reliable track record of EOL turnover. City sets for example. Is the set from a "one off" theme like Monster Fighters etc? How long have others within the theme stuck around for? Does the theme refresh itself with new release waves replacing older ones at regular intervals?

- Retail stock levels - is the set getting hard to find on store shelves. Talked to the manager about ordering more and they can't get any? This adds to the picture.

- Rumors and aggregate opinions of store employees - Yes Lego or other store employee information is usually meaningless and baseless when taken at an individual level. However, did the information come from a store drone or from a manager - even then it's still not bankable. But start to hear the exact same story from 5 or 10 different sources and you can put greater strength in the information being accurate. That leads into;

- Information from the forums - people spend a lot of time talking EOL dates here. Again, isolated information needs to be examined as to its source (is the member reputable and well known for having a proven track record of insight etc?). People discuss the above factors and more and often come up with a loose consensus of when a set may EOL. Take that information and apply your own logic to it and come up with your own gut feelings - then share it back on the forums like others do to help refine it.

OK, now you should have some estimate of an EOL date. What you need to do is take the time difference between today (the day you are looking at buying) and that EOL date, in years. E.g. if today is 1 Jan and I think the set will go EOL around the end of June, so that is 0.5 years. This EOL timeframe is important as it give us the window in which it should still be possible to pick up the set from a retailer.

If you want to be a bit more accurate than just taking an approximate value in years the formula for calculating it is: EOL date minus todays date to give a value in days then divide that by 365 to give a value in years.

Expected Price before EOL

The 4th thing we need relates a little to the EOL date above. We need to have a gauge on what a future retail price opportunity may be on or just prior to the set going EOL. This lets us factor in possibly holding off on the purchase now in order to pick it up later. Worst case scenario you can use the full retail price (MSRP). If you have access to a Lego retail store or have a Lego Shop at Home (Lego’s online store) retail price for your region that is the same as the one at the retailer you are deciding on, then you can take an automatic 5% discount if you belong to their VIP programme.

There are also plenty of sets that have frequent discounts. Or you may be in a locality where stores often have Lego clearance sales when sets get close to or go EOL. In that case insert a discount price that you are confident of being able to secure near the EOL date.

Combining the Variables into a Formula

Ok so you should have values for the variables we need. Here is a summary

- Price (P) in $ - the final price of the set you are considering

- Average Annual Rate of Return (AARR) as a % - your opportunity cost return that you could get by investing elsewhere

- Expected EOL Timeframe (EOLT) in years – the amount of time in years between todays date and the date you estimate the set will go EOL

- Expected Price before EOL (EOLP) – the price you expect to be able to still get the set for just before EOL

Now we need to introduce a little math. Using the abbreviations above, insert your values into this formula to find the amount of money you will be better off by or worse off by if you purchase the set:

Value = EOLP - ((P x AARR x EOLT) + P)

If you’re ‘not a math person’ and that seems a bit scary here is a step by step run through of how to calculate it:

- Take the price of the set and multiply by you Average Annual Rate of Return (e.g. if 30% then 0.3)

- Take that result and multiply by your expected amount of years until EOL date (this result is your opportunity cost)

- Take that and add the set price to it (this is the amount of money you could have at the EOL date if you don’t by the set and invest it elsewhere)

- Take the estimated price of the set at EOL (after any discounts e.g. 5% or even MSRP) and minus the result from step 3

The result you are left with will be either a positive or negative dollar value. If it is positive then this is the value you would be better off by if you purchase the set – so you should probably buy it. If it is negative it represents the amount you will be worse off by if you purchase the set as you could make more money by investing elsewhere and then buying the set later – so you should probably hold off.

The result is obviously only as accurate as the info you use to feed into it. As we talked about above the variables themselves can have a lot of estimation involved in them. For this reason I would like to suggest building in a tolerance margin for the outcome. I feel a tolerance margin of plus or minus 5% is reasonable to consider as a start point. If you feel your variables are quite accurate you can narrow the tolerance margin and if on the other hand you think you’ve made some pretty wild guesses or it’s just too hard to know you can increase them.

Take the Value you have calculated and divide it by EOLP. Then multiply by 100 to give a percentage result. If the result falls between -5% and +5% then it is in the tolerance band and the decision is too close to call. If it is over +5% then you should buy it, if below -5% then consider investing elsewhere.

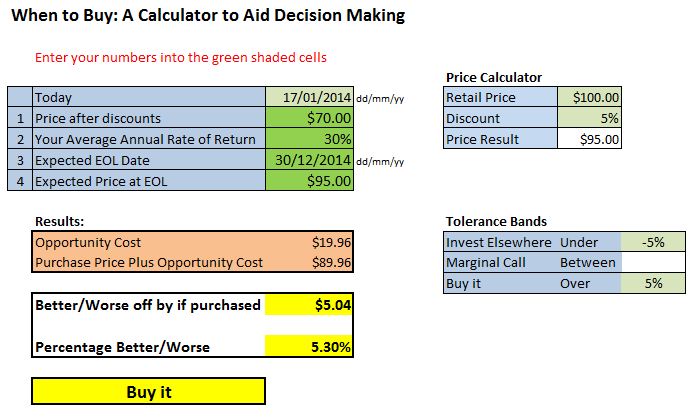

If you are an Excel user I have created a simple spreadsheet that you can plug the variables into that does all the calculations for you. If you would like a copy please ask in the comments below or send me a forum PM, here is a screenshot:

(note for the majority of you that will be from the US, the date format is d/m/y – as it should be ![]() )

)

You can input all your variables, changes the tolerance bands and there is a price calculator to the side for quickly figuring out prices after discounts. Feel free to play with it, change it, and adapt it to your needs if you have the will and technical capability.

Caveats and Other Variables to Consider When Buying

As mentioned previously there are a number of factors that come into play when making a buying decision. The tool I have developed really only simplifies a few of the major ones. Once you come up with a result from it, you should then consider these other factors as well that will likely influence your decision. Here is a list of a few of these other variables:

- Capital restrictions – do you have the available funds to make the purchase? As funds get tighter you’ll need to likewise tighten your buying decisions to make only the very best purchases, or come up with more capital possibly decreasing your AARR if you borrow

- Storage restrictions – can you fit more sets in your house? Can you use storage from friends/family. Or are you large scale enough to pay for a storage facility, again impacting your AARR

- Your risk appetite – Are you a conservative or risk taking investor?

- Diversification – do you put more or less weight on buying this set because you want it in your portfolio to increase your diversification?

- Investor Scale – Small to medium investors can probably get away with only buying their sets close to EOL. But large scale investors need to spread their purchases over longer periods both for logistical reasons as well as trying to avoid possible buying limit restrictions.

- Time restrictions – The ‘cost’ of time was discussed above, but there is also the fact that time is a limited resource. As you grow your investment portfolio there is only so much time you can spare to hunt deals and have available to sell your inventory to cash out. Otherwise you’re going to have to hire someone or have a sympathetic partner!

- Stock shortages or limited time deals – is the deal so good or supply so low that the set may disappear if you don’t act fast?

Those factors combined with the multitude of things that also go into the 4 variables we have attempted to use all mean that buying decisions can never be an exact science. Hopefully though we have gone someway into simplifying part of the decision or at the very least mapped out the process for that decision making. Even if you don’t use the formula I hope you have taken something from it to enhance your own process.

As for when to sell, that’s a whole other discussion and probably has more variables involved than buying decisions! Everyone has different strategies that work for their individual circumstances and there are a few good articles and forum discussions on the topic as well.

In conclusion, I’d like to invite constructive criticism and discussion on the topic in the comments below. Feel free to pick holes, tear apart, mull over, or send effusive gifts. This is by no means a finished product and by sharing our knowledge and thoughts we can all improve our investment capabilities.

Recommended Comments

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.